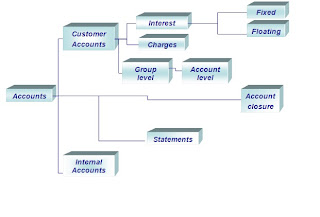

In T24, accounts can be classified as two types : Customer and Internal.

The Account Module caters for creation and maintenance of all types of accounts handled by Temenos T24. It also provides for:

- calculation, accrual and application of interest on customers' accounts. Interest could be either Fixed or Floating

- calculation of charges relating to the maintenance and servicing of accounts.

- production of account statements and overdraft and referral reports.

- Accounts within T24 are classified as Customer accounts or Internal accounts.

- Customer accounts are those owned by an external customer such as current accounts, savings accounts etc.

- Interest and charges can be applied to Customer accounts.

- Internal accounts are those owned by the bank e.g. suspense accounts, cash accounts and not designed to calculate or apply interest and charges

- Customer Accounts

- These include any accounts related to a customer and are identified by account numbers of up to 14 digits including the check digit.

- In addition to the account number and the customer record to which the account relates, the record contains details such as: Currency, Category, Limit, Account Officer etc.. Customer details such as name, nationality, residence etc., are held in the customer base record and will be taken from that record as and when required.

Menus and sub menus are arranged in a logical business sequence to take care of opening and maintaining Account and related applications.

Savings Account in local and foreign currencies can be opened through Open Savings Account LCY and Open Savings Account FCY sub menus respectively.

Current Account and Nostro Accounts can be opened through Open Current Account and Open Nostro Account sub menus respectively.

Accounts can be amended using Amending of Account sub menu. Authorising and Deleting unauthorised accounts could be done through Authorising and Deleting Unauthorised records sub menu.

Account closure sub men can be used to close an existing account.

Account Maintenance sub menu can be used to for resetting Inactive accounts, Blocking of funds, Changing frequency of Statements, setting debit interest and credit interest rates at account level, besides Account Capitalisation.

User can look into Account related enquiries such as Account list, Accounts of a Customer, Today’s Account balance, ,Average Account balance, Account statements, etc.

User can view COB reports – Trial balance details and Account balance list

Opening Savings Account in local currency can be done by filling up the Basic Input section.

All mandatory fields are displayed in the Basic Input Section. By filling up these, a Savings Account in local currency can be opened.

It is possible to open a Savings Account in local currency by inputting only one mandatory field viz. CUSTOMER ID. All the other fields are optional or get default values

Product code is set to default 6001 in Model Bank, which is for Savings account.

Next to Customer, Account is central to all other applications in T24. We need accounts to have Customer type of accounts like Savings and Current accounts.

We also need accounts to reflect balance of our Nostro accounts held with outside banks.

In addition, all contract applications in T24 need accounts – either Customer type or Internal accounts for moving money – be it for giving a loan or taking a deposit.

Even if a Customer does not have an account with us, we need to have atleast a Nostro account or internal accounts like Suspense account or Cash account to deal with Customer.

<a href="http://phpweby.com/hostgator_coupon.php">hostgator coupons</a>

These types of banking services offer higher annual percentage rate than regular savings accounts do. This is likely to be attractive to a consumer who is interested in do a comparison before deciding on what type of account to choose for savings and investment. Please visit me at High Interest Savings Account.

ReplyDeleteT24

ReplyDelete